DIBIL in Mathematical Economics

by Joseph Mark Haykov

October 22, 2024

Introduction

Formal systems are foundational frameworks in mathematics and science designed to eliminate the possibility of making logical thinking errors. In any formal system, a theorem that has been proven to be correct becomes an established fact within that system. Formal systems consist of:

Formal language: Used to express statements precisely.

Axioms: Assumed truths within the system that serve as the starting points for reasoning.

Rules of inference: Define how new statements can be logically derived from axioms and previously established theorems.

These components enable conclusions to be deduced from initial premises through rigorous reasoning, ensuring that conclusions follow inevitably from the assumptions. In mathematics, a formal system begins with axioms and definitions, from which lemmas, theorems, and corollaries are derived using formal inference rules. This structured approach guarantees that conclusions are consistent with the axioms, making formal systems critical not only in mathematics but also across various scientific disciplines.

In applied formal systems, such as those used to model objective reality in physics, facts are assertions whose truth can be independently verified. Physics, which studies the fundamental laws governing the universe, serves as a robust framework for understanding objective reality—particularly phenomena that are measurable and observable. However, depending on one’s philosophical perspective, other frameworks like metaphysics, logic, or mathematics may also be considered foundational to understanding different aspects of reality.

While quantum mechanics—which includes concepts like wave-particle duality—describes physical phenomena at the microscopic scale, other theories like general relativity are necessary to describe gravitational phenomena on macroscopic scales. A unified theory that fully integrates quantum mechanics with general relativity remains an open challenge in physics. Nevertheless, it remains an indisputable fact that our shared reality involves fundamental particles and fields, as described by physics. This encompasses not only known particles and forces but also phenomena like dark matter and dark energy, which are still subjects of ongoing research. Importantly, while dark matter and dark energy are strongly supported by observational evidence, their exact nature remains an open question. Physics, therefore, aims to study all that exists in our shared objective reality—that is, all that is real.

Everything in our shared objective reality involves fundamental particles and fields, as described by physics. This implies that concepts like existence, objective facts, and independent verifiability are deeply interconnected within the discipline. If we posit, as a self-evident truth, that nothing unreal exists by definition, then all that exists in this shared objective reality of ours is real. This, in turn, means that any logical claims about our shared objective reality must be independently verifiable for accuracy.

This logically follows from the definition of the term “objective,” which inherently requires independent verifiability. In this shared objective reality of ours where nothing unreal exists, the key distinction between objectively true logical claims—which we refer to as objective facts—and subjective opinions is that objective facts are verifiable in our shared existing reality. This distinction is the fundamental difference between a hypothesis and a real-world objective fact.

Objective, real-world facts may refer to either empirical observations or mathematical truths. This definition captures two distinct categories of facts:

Empirical Facts: Statements whose truth can be confirmed through observation or experimentation. For example, the fact that the Earth is roughly spherical, not flat, is verifiable by observing satellite images, circumnavigating the globe, or measuring the Earth’s curvature through experiments. Similarly, the existence of the pyramids is an empirical fact, observable by visiting Egypt.

Mathematical Facts: Statements proven within a formal mathematical system, based on its axioms and inference rules. For instance, the correctness of the Pythagorean theorem is a fact in Euclidean geometry because its proof follows logically from Euclidean axioms. Anyone familiar with Euclidean geometry and its deductive rules can verify this fact by following the theorem’s proof.

A common characteristic of both empirical and mathematical facts is their independent verifiability—their truth can be established by any rational individual. However, the methods of verification differ: empirical facts are confirmed through sensory experience or experimentation, while mathematical facts are validated through logical deduction within a formal system.

In formal mathematics, a statement is syntactically true if it can be derived from the axioms via inference rules. This contrasts with empirical facts, which must be semantically true in the real world, grounded in observed data. This distinction defines "objective" in both formal systems and reality, as statements that are independently verifiable by others.

For objective empirical scientific facts, reproducibility of experiments is necessary for their acceptance. Similarly, for mathematical facts, a proof must be rigorously checked and verified by other mathematicians to ensure consistency and correctness within the given formal system.

The distinction between hypotheses and theorems highlights why some mathematical claims, such as the Riemann Hypothesis, remain unresolved and are not yet considered established facts. While a hypothesis may seem likely to be true, its status as a fact is contingent upon being proven within the current axiomatic system. This is because any underlying conjecture or assumption could turn out to be false.

For instance, Euler’s conjecture—a generalization related to Fermat's Last Theorem—was proposed by Leonhard Euler in 1769 but was disproven in 1966 by L. J. Lander and T. R. Parkin, who discovered a counterexample through a computer search. Hypotheses are thus conjectures proposing potential truths within a formal system, awaiting rigorous proof. Once proven, they become theorems and are considered objective facts within that system.

This process is exemplified by Fermat’s Last Theorem, which remained a conjecture for centuries until Andrew Wiles provided a proof in 1994. Similarly, the Poincaré Conjecture was proposed by the French mathematician Henri Poincaré in 1904. This famous problem in topology, particularly in the study of 3-manifolds, remained unsolved for nearly a century until it was proven by Grigori Perelman in 2003. In contrast, proven theorems, such as the Pythagorean theorem, cannot be false within the axiomatic structure of Euclidean geometry.

In Euclidean geometry, the Pythagorean theorem is classified as an objective fact because it holds universally under Euclid’s axioms, and its proof can be independently verified by anyone using these axioms and inference rules. This logical consistency allows even students to confirm its truth early in their mathematical education.

However, in non-Euclidean geometries, the Pythagorean theorem does not hold in its standard form. In curved space, the sum of the squares of the sides of a right triangle no longer equals the square of the hypotenuse. This means that the curvature of space affects how distances are measured.

This reflects the broader principle that mathematical facts are contingent upon the axioms and definitions of the specific formal system in which they reside. For example, in Riemannian geometry—where space curvature is crucial for understanding phenomena like general relativity—different geometric principles must account for this curvature.

Clocks on GPS satellites, for instance, must account for time dilation due to both their relative velocity (special relativity) and the difference in gravitational potential (general relativity), demonstrating the need for modified geometric principles. These relativistic effects are essential for the precise functioning of the Global Positioning System, highlighting how advanced mathematical frameworks are applied to real-world technologies.

The universal principle of logic and rationality—using deductive reasoning to arrive at logically valid conclusions—ensures that any rational individual can derive the same result from the same premises within a formal system. Logically valid conclusions are those that follow inevitably from the system’s axioms and inference rules, ensuring that theorems like the Pythagorean theorem are verifiable by anyone working within the framework of Euclidean geometry.

This logical formal system framework also allowed Isaac Newton to apply mathematics effectively to describe the laws of physics. Newton used deductive reasoning within his formal system of classical mechanics to model physical laws based on empirical observations. For example, Newton’s laws of motion were formulated based on observations but expressed mathematically with the same logical rigor as a formal system, connecting assumptions to conclusions through rigorous deductive logic. This rational structure explains why mathematical formulations of physical laws are universally verifiable within their respective systems, while the laws themselves are subject to empirical validation through experimentation and observation.

Proofs as Facts

In formal systems, proofs are regarded as objective facts because their truth is established through a process of logical deduction from axioms and inference rules, and their correctness is independently verifiable. A key characteristic of mathematical proofs is this independent verifiability: anyone with knowledge of the system’s axioms and rules of inference can follow the logical steps of the proof and arrive at the same conclusion. This verifiability transforms the correctness of proofs—and the truth of resulting corollaries, lemmas, and theorems—into objective facts within the formal system.

Once a proof has been rigorously derived and verified, it is considered correct within the context of the system in which it was produced, such as algebra or arithmetic. However, historically, errors have been found in accepted proofs, and the mathematical community relies on peer review and replication to ensure the correctness of proofs. For instance, within the framework of Peano’s axioms of arithmetic, the statement 2+2=4 is not a hypothesis—it is an objectively proven fact. The logical deduction from Peano's axioms leads inevitably to this conclusion, and anyone familiar with basic arithmetic can verify it, making it a universally accepted truth.

Proofs are thus logically reliable within a consistent formal system. Their truth—or more precisely, their correctness—guarantees the truth of the theorems derived from them, entirely dependent on the internal logic and coherence of the system’s axioms and rules of inference. If the formal system is consistent—meaning no contradictions arise from its axioms—then any statement proven within the system is guaranteed to be true in that context. Therefore, the only way a proven statement could be considered unreliable is if the axioms themselves are inconsistent, because in an inconsistent system, any statement can be both proven and disproven due to the principle of explosion (ex contradictione sequitur quodlibet). This is why, in scientific theories that model reality using mathematics, the validity of the theory’s conclusions depends not only on the correctness of the mathematical proofs but also on the empirical validity of the axioms when tested against observed facts.

In applied formal systems, such as those used in physics or chemistry, the axioms are based on empirical observations or definitions that align with real-world data. These empirical axioms are provisional and subject to revision based on new evidence. Any logically consistent scientific theory is, by definition, also an applied formal system and relies on both logical consistency and empirical accuracy. However, it is important to clarify that, unlike purely abstract mathematical systems, applied formal systems are contingent upon the empirical correspondence to reality of their axioms. For example, Newton’s laws of motion can be seen as axioms that describe how physical systems behave. As long as these laws are consistent with empirical evidence, the theorems derived from them—such as equations of motion—are considered both mathematically and physically valid. However, if new evidence shows that the axioms conflict with observed reality, the theory itself must be revised or discarded. In contrast, in purely abstract formal systems, such as those in mathematics, proofs remain valid as long as the system's axioms are internally consistent, irrespective of any external or empirical considerations.

Gödel’s Incompleteness Theorems introduce an important limitation to our understanding of formal systems. These theorems demonstrate that in any sufficiently powerful formal system capable of expressing arithmetic (such as one based on Peano’s axioms), there will always be statements about numbers that are true but cannot be proven within the system’s axioms; these statements are undecidable within the system. While this constrains the completeness of formal systems, it does not undermine the reliability of proven theorems. So long as the formal system is consistent and sound, any theorem derived from the axioms is guaranteed to be true within the system.

However, it is imporant to note that this guarantee of truth is contingent upon the internal consistency of the system’s axioms. In other words, the "truths" hold only within the confines of the formal structure defined by the system's axioms. For instance, the Pythagorean theorem is correct within the framework of Euclidean geometry because no contradictions have been found within Euclid's axioms, but this theorem does not hold in the same way in hyperbolic geometry, where the underlying axioms differ.

This interplay between completeness and consistency highlights the boundaries of formal systems. Although we may not be able to prove every true statement within a system, the truths we do prove are indisputable as long as the system remains consistent. This is why established mathematical theorems, such as those in number theory or geometry, have endured over time—any inconsistencies would have been exposed through the rigorous process of independent verification. While Gödel’s theorems indicate that formal systems have intrinsic limitations, they do not diminish the reliability of proven theorems within a consistent framework—a key point often overlooked.

Dual Consistency in Applied Formal Systems

Errors in representing reality can occur in two fundamental ways: a Type I error (a false positive, rejecting a true claim—akin to disbelieving an honest person) or a Type II error (a false negative, failing to reject a false claim—akin to believing a liar). These two categories are commonly understood in statistical hypothesis testing and illustrate potential pitfalls in scientific and mathematical reasoning. In a sound formal system, such errors do not arise if the rules of deduction are properly followed, leading to correct conclusions derived from the axioms and inference rules.

When evaluating any logical claim, whether within a formal system or in real-world scenarios, there are only four possible outcomes:

Correct Decision: Accepting a true claim.

Correct Decision: Rejecting a false claim.

Type I Error: Rejecting a true claim.

Type II Error: Accepting a false claim.

In formal systems, a hypothesis refers to an assertion, statement, or proposition that remains unproven or uncertain. For example, the Riemann Hypothesis—a conjecture about the distribution of prime numbers—is widely believed to be true but has not yet been proven. A hypothesis in formal systems is neither inherently false nor true; it is simply a proposition awaiting proof or disproof based on the system's axioms. This concept mirrors the statistical notion of a hypothesis, where uncertainty persists until sufficient evidence is gathered to either reject or fail to reject any claim. In both formal systems and statistics, a hypothesis represents an uncertain conjecture requiring validation through logical deduction or empirical testing.

However, in formal systems such as algebra, we do not reject the Riemann Hypothesis as false; we merely acknowledge it as unproven, though it is widely believed to be true. This is not equivalent to incorrectly rejecting a true claim, so it does not constitute a Type I error. Likewise, we are not accepting a potentially false claim as true, so there is no risk of a Type II error. In formal systems, hypotheses exist in a provisional state—they are neither accepted nor rejected until proven. Once a theorem is proven, it is universally true within the system, assuming the system is consistent. Thus, neither Type I nor Type II errors, as defined in statistical hypothesis testing, are directly applicable to a formal system with consistent axioms. In a correct formal system, theorems are guaranteed to hold universally, provided the axioms themselves are internally consistent.

Gödel’s Incompleteness Theorems introduce an important caveat to this understanding. These theorems demonstrate that in any sufficiently powerful formal system capable of describing arithmetic (such as one based on Peano’s axioms), there will always be true statements that cannot be proven from the system’s axioms. For example, it is possible that certain propositions are undecidable within the system—they can neither be proven nor disproven using those axioms. However, it remains uncertain whether specific conjectures like the Riemann Hypothesis are independent of Peano Arithmetic or simply remain unproven using our current methods. This situation does not represent a Type I error because we are not rejecting a true claim; rather, we are unable to prove the claim within the system. Therefore, the incompleteness demonstrated by Gödel does not involve traditional errors as understood in hypothesis testing. Instead, it shows that a formal system may contain true statements that are unprovable within its own framework. Such unproven or unprovable propositions are classified as hypotheses in formal systems.

Dual Consistency in any applied formal system requires that the system's axioms avoid both internal contradictions and contradictions with established empirical facts:

Internal Consistency: The system's axioms must not lead to contradictions. This ensures that the system’s logic is sound and that any theorems derived from these axioms are valid within the system.

External Consistency: The system's axioms must not contradict empirical observations. For applied sciences, this means that the axioms must align with real-world data. If an axiom is found to conflict with empirical evidence, it may need to be revised to maintain the theory's relevance to real-world phenomena.

When these two forms of consistency are ensured, the theorems derived from the system’s axioms hold true not only within the abstract formal system but can also be applied successfully in practice. For example, the mathematical models of Newtonian mechanics remain effective in many real-world applications as long as Newton's laws—the axioms of the system—are consistent with the observed behavior of physical systems. However, in regimes such as relativistic or quantum mechanics, where Newtonian axioms no longer apply, the formal system must be revised to maintain external consistency with empirical data.

A well-known example that illustrates the need for dual consistency involves the application of mathematical concepts to physical reality. Peano’s axioms define the natural numbers and include the principle that every natural number nn has a unique successor n′n′, implying an infinite set of natural numbers. While this mathematical concept of infinity is fundamental, physical quantities are inherently finite—we can count only a finite number of objects, such as the two moons of Mars.

When considering the equation 2+2=4, it remains a mathematical truth. However, applying this equation to Mars's moons assumes the availability of four countable moons, which contradicts the physical reality of only two moons. This discrepancy highlights that, under the framework of dual consistency, the mathematical model loses external applicability in this context. Similarly, while Euclidean geometry is internally sound, it does not accurately describe the curved space-time of our universe, where Riemannian geometry serves as a more applicable model.

When counting Mars's moons, an appropriate mathematical model would account for the finite number of moons without altering the fundamental axioms of arithmetic. This underscores the importance of selecting suitable models when applying mathematical concepts to the real world. It highlights that while mathematical truths are universally valid within their formal systems, their application to physical scenarios must account for empirical constraints by ensuring that the models and assumptions are consistent with real-world observations.

Given axioms that are both internally consistent and externally applicable—what we refer to as dual consistency—all corollaries, lemmas, or theorems derived from them are likely to hold true within both the formal system and, when properly aligned, in relation to the real world. Without such dual consistency, the applicability of theorems to reality may be limited, rendering the mathematics purely theoretical in certain contexts. This distinction creates a clear delineation between applied mathematics and purely theoretical mathematics.

Applied mathematics employs mathematical theories and models to solve practical problems, relying on logical deductions from established axioms and ensuring that these models accurately reflect empirical observations. This is the practical value of applied mathematics, in contrast to purely theoretical mathematics, which explores logical structures without immediate concern for empirical applicability.

In conclusion, proofs in formal systems are objective facts because they result from valid logical deductions from a set of consistent axioms. These proofs, when verified independently, are reliable within the formal system. In applied formal systems, the reliability of these facts extends to the real world as long as the system's axioms are both internally consistent and appropriately aligned with empirical facts. By ensuring dual consistency, formal systems can yield conclusions that are both logically valid and empirically applicable, thereby bridging the abstract and real-world domains.

Universal Causality in Formal Systems: The Foundational Principle of All Mathematics

The effectiveness of logical deduction in modeling reality under dual consistency is grounded in the principle of logical causality, which governs the relationship between premises and conclusions in formal systems. In this context, logical causality refers to the same concept as logical implication or logical inference—the process by which conclusions necessarily follow from premises according to established inference rules. This principle parallels physical causality, as exemplified by Newton’s laws in classical mechanics. For instance, Newton's third law, which states that for every action, there is an equal and opposite reaction, highlights the deterministic role of causality in the physical world.

Similarly, in formal systems, logical causality embodies the idea that if the inference rules—based on the "if cause, then effect" structure inherent in deductive logic—are properly applied, and if the axioms of the formal system are consistent with reality, then the theorems derived from those axioms will also hold true in reality. This is because the inference rules, which govern the logical steps used to derive theorems, are designed to reflect the necessary relationships between premises and conclusions. In other words, the logical structure of formal systems aligns with the universal causality that governs real-world phenomena by ensuring that valid conclusions (effects) logically follow from true premises (causes).

Furthermore, these inference rules ensure internal consistency within the formal system itself. Fundamental principles such as the law of excluded middle and the law of non-contradiction help prevent contradictions within the system. Thus, the applicability of theorems in reality depends on whether the axioms accurately reflect empirical observations. For instance, Euclidean geometry holds true in flat space, but when applied to curved space—as in general relativity—its axioms no longer correspond to the empirical reality of that space. Hence, while logical causality guarantees the internal consistency of a formal system through valid inference, the external validity of the system depends on the truth of its axioms when tested against real-world phenomena.

This deterministic relationship between axioms (causes) and theorems (effects) ensures that conclusions derived within formal systems are logically consistent, and under dual consistency conditions, are also universally applicable in reality. These dual consistency conditions are:

The axioms correspond to empirical reality.

The inference rules, reflecting logical causality, are correctly applied to derive valid conclusions.

This principle is illustrated by a simple example: when the axioms of arithmetic hold true, the statement 2+2=4 is valid both within the formal system and in the real world. Here, the logical causality inherent in the arithmetic operations ensures that the conclusion logically follows from the premises, aligning mathematical truth with empirical observation.

Causality in Physics and Recursion in Formal Systems

In physics, causality governs the relationship between events—where one event (the cause) leads to another (the effect). This principle is fundamental across various domains, including electromagnetism, thermodynamics, and advanced theories like general relativity and quantum mechanics. In none of these domains is causality empirically observed to be violated. Even in general relativity, causality dictates the relationships between spacetime events, preventing faster-than-light communication and ensuring that causes precede effects within the light cone structure of spacetime. Similarly, in quantum mechanics, although individual events are probabilistic, causality is preserved at the statistical level, with overall behavior governed by conservation laws such as those for energy and momentum.

In formal systems, logical causality—as we've defined it to be synonymous with logical inference—serves a similar function. Axioms (causes) lead to theorems (effects) through inference rules grounded in logical deduction, where each step deterministically leads to the next. This mirrors the way physical causality governs the progression of events in the physical world, albeit in a metaphorical sense within the realm of abstract logic. The structured progression of logical inference ensures that conclusions are logically consistent with premises, just as physical causality ensures that effects follow causes in a predictable manner.

The analogy extends to recursion in computation, where one computational step leads deterministically to the next, much like one physical event triggers another. Just as recursive functions in programming define a sequence of actions, recursive logical steps in formal systems define how one truth leads to another. The effectiveness of modeling reality using formal systems arises from this structural correspondence to physical causality. Recursion and logical inference mirror the cause-and-effect relationships inherent in the physical world, suggesting that recursive programming can fully define aspects of our reality.

While Turing machines are a foundational model of what is computable in theory, recursive lambda functions are equally powerful and capable of computing anything that a Turing machine can compute. Programming languages like Scheme—which emphasize recursion—are Turing-complete and provide a perspective on how computation can be structured entirely around recursive processes. Scheme's recursive structure reflects a cause-and-effect approach in computation, illustrating how complex operations can be built from simpler ones through well-defined recursive rules.

By acknowledging these parallels, we can appreciate how concepts of causality and structured progression permeate physical theories, formal systems, and computation in general. Since everything can be modeled using recursion, logical inference, and binary logic, this suggests that reality itself operates fundamentally on principles akin to causality. This understanding underscores the importance of selecting appropriate models and paradigms when exploring complex phenomena, whether in the physical world or within abstract computational frameworks.

Causal Determinism in Logical and Physical Systems

The deterministic nature of processes in both logical and physical systems ensures that outcomes follow predictably from their starting points, given the governing principles. In formal systems, if the axioms are consistent, then the theorems derived from them follow with certainty, provided the inference rules—which systematically guide logical deduction—are applied correctly. This deterministic relationship between axioms and theorems supports the internal consistency of the formal system, ensuring that no contradictions arise from valid deductions.

Similarly, in the physical world, if we know the initial conditions and the laws governing a system, we can predict its future behavior with a high degree of certainty in classical mechanics, or probabilistically in quantum mechanics. Even though individual quantum events are probabilistic, the overall behavior of quantum systems adheres to causal principles, with statistical predictability maintained through conservation laws and the deterministic evolution of the wave function as described by the Schrödinger equation.

In quantum mechanics, causality is preserved in a nuanced form. Despite the inherent randomness of individual quantum events, interactions still comply with fundamental conservation laws, such as those governing energy and momentum. While specific outcomes cannot be predicted with certainty, the statistical distribution of outcomes conforms to precise mathematical formulations. This probabilistic framework does not violate causality but represents it in terms of probabilities rather than deterministic outcomes. Thus, conservation laws ensure that causal relationships are maintained at the statistical level, even when individual events are unpredictable. Unpredictability in quantum mechanics reflects the probabilistic nature of underlying physical processes, not a breach of causality.

In both contexts—logical systems and physical systems—the "if-then" structure plays a crucial role. In formal systems, logical deduction ensures that conclusions (theorems) follow necessarily from premises (axioms) through valid inference rules. In physical systems, cause-effect relationships ensure that effects follow causes in a consistent and predictable manner, governed by physical laws. While the domains are different—abstract reasoning versus empirical phenomena—the structured progression from premises to conclusions or from causes to effects underscores a foundational aspect of determinism in both logic and physics.

Universal Causality and Its Limitations

While the principle of universal causality ensures that every effect has a cause, there are inherent limitations on what can be known and predicted about these causal relationships. These limitations are well-documented in both formal systems and physical reality.

Gödel’s Incompleteness Theorems show that in any sufficiently powerful formal system capable of expressing arithmetic, there are true statements that cannot be proven within the system. This sets a limit on what can be deduced from a set of axioms, introducing fundamental constraints on our ability to derive all truths solely from logical deduction.

In physics, the Heisenberg Uncertainty Principle restricts the precision with which certain pairs of properties—such as position and momentum—can be simultaneously known. This reflects a fundamental limit on measurement and affects our ability to predict exact outcomes, even though the underlying causal processes remain consistent.

Turing’s Halting Problem demonstrates that there are computational problems for which no algorithm can universally determine whether a given program will halt. This introduces yet another form of undecidability, highlighting limitations in computational predictability and our capacity to foresee all computational behaviors.

These limitations illustrate that while causality—both logical and physical—remains a foundational principle, there are intrinsic constraints on predictability and knowledge. However, these constraints do not undermine the underlying causal structure of the universe. Instead, they highlight the complexity of systems, where specific effects may be difficult or impossible to predict in detail, even though the broader causal relationships are well-understood.

Acknowledging these limitations encourages a deeper exploration of systems, accepting that uncertainty and undecidability are inherent aspects of both mathematics and the physical world. This understanding emphasizes the importance of developing models and theories that can accommodate these intrinsic limitations while still providing valuable insights into the causal relationships that govern reality.

Conclusion: Logical Causality as the Foundation of Reasoning

In both formal systems and physical reality, the principle of causality serves as the backbone of predictability and understanding. In formal systems, logical causality—our term for the logical inference embedded within deduction—ensures that theorems are valid consequences of axioms. Similarly, physical causality ensures that effects are the result of preceding causes in the physical world.

The deep connection between these two forms of causality—logical and physical—lies in their shared progression from cause to effect, explaining why formal systems can model reality precisely when their axioms align with empirical observations.

Thus, the principle of universal causality—applied to both physical and logical systems—provides a robust framework for bridging the abstract and physical realms. By grounding the if-then structure of deductive reasoning in axioms consistent with empirical facts, we ensure that our formal systems remain aligned with the real-world behaviors observed in the universe.

The First, One-Truth Postulate of Mathematics

The concept of causality, which exhibits a recursive nature (where effects can become causes for subsequent events), extends beyond computation into the physical world, functioning similarly to an inductive process in formal logic. Just as induction allows us to derive general principles from specific instances, causality applies universally to all formal systems and is not contradicted by any known formal system. This forms the foundation of the "if-then" logic that governs all deductive reasoning in our shared reality. This is why causality is independently verifiable across both abstract (mathematical) and physical domains. In essence, "if cause, then effect" represents the fundamental structure of both physical reality and formal logical systems, uniting them under the principle of universal causality.

It is as though the inherent causality of the universe has imprinted itself onto human cognition through the process of inductive reasoning (the method of reasoning from specific observations to broader generalizations). This internalization manifests as rational logic, providing a shared basis for universal agreement on the truth of any logically deduced claim—so long as the underlying system remains logically consistent and adheres to the rules of "if-then" logic. In this way, the universal law of causality governs both the abstract realm of formal systems and the tangible workings of the physical world, ensuring a cohesive framework for understanding reality.

If we propose, as a foundational axiom—the first "one-truth" postulate of all mathematics in any formal system—that causality holds universally, we assert that every cause, in every context, results in an effect. In other words, not some actions, not most actions, but all actions—without exception—produce an effect. This aligns with a key principle in science: every event or change has a cause, and by investigating deeply enough, we can uncover it. In the physical world, this principle is exemplified by conservation laws governing quantities such as energy and momentum, which are preserved through causal processes. To date, nothing in observed reality contradicts this fundamental law of causality.

In mathematics and logic, the principle of causality underpins the structure of formal systems: each logical deduction (the effect) follows necessarily from its premises (the cause). The "if-then" structure of deductive reasoning mirrors the relationships inherent in mathematical systems, where conclusions follow inevitably and consistently from the assumptions, provided the system is consistent. This reflects the deterministic nature of logical implication in well-defined formal systems, analogous to the deterministic nature of classical physical processes.

Thus, the universality of formal systems is grounded in consistent logical principles that reflect the causality observed in the physical universe. This deep connection explains why formal systems, when based on axioms consistent with empirical facts, can model reality with such precision and reliability. Both mathematics and physics rely on consistent, predictable relationships between premises and conclusions to develop robust theories that are logically sound and empirically valid.

Limits to Predictability

While the principle of universal causality ensures that every cause has an effect, there are well-known limitations to what is knowable. These limitations are demonstrated by Gödel’s Incompleteness Theorems, the Heisenberg Uncertainty Principle, and Turing’s Halting Problem, as discussed earlier. These insights make one thing clear: even though we may understand the rules that govern systems, the outcomes—the effects of actions—may still be unpredictable or unknowable in certain instances due to inherent limitations such as randomness or complexity in the universe.

However, this unpredictability does not undermine the causal structure of the universe. Instead, it highlights the complexity of systems where specific effects are difficult to predict, even though the broader causal relationships remain well understood. This reflects a fundamental constraint on our ability to foresee the future with absolute certainty. The precise effects of causes may be elusive due to intrinsic randomness or the complexity of interactions in the universe, even when the underlying causal structure is fully grasped.

The unpredictability inherent in quantum mechanics and other complex systems emphasizes the distinction between knowing the rules and being able to predict specific outcomes. This is akin to knowing everything about football but being unable to accurately predict who will win any given game. Even though the system is far from random—for example, the weakest professional club will almost certainly beat a high school team—prediction can still be elusive when the competitors are closely matched.

This concept resonates with broader philosophical and theological ideas, such as the notion of "forbidden knowledge" mentioned in ancient texts like the Torah—a text that has existed for over 2,000 years. In this context, "forbidden knowledge" refers to insights beyond human comprehension, understood only by God, the "creator of the original source code" of the universe. While these philosophical discussions extend beyond the scope of this paper, they offer intriguing parallels to the limits of human understanding in both formal systems and natural laws.

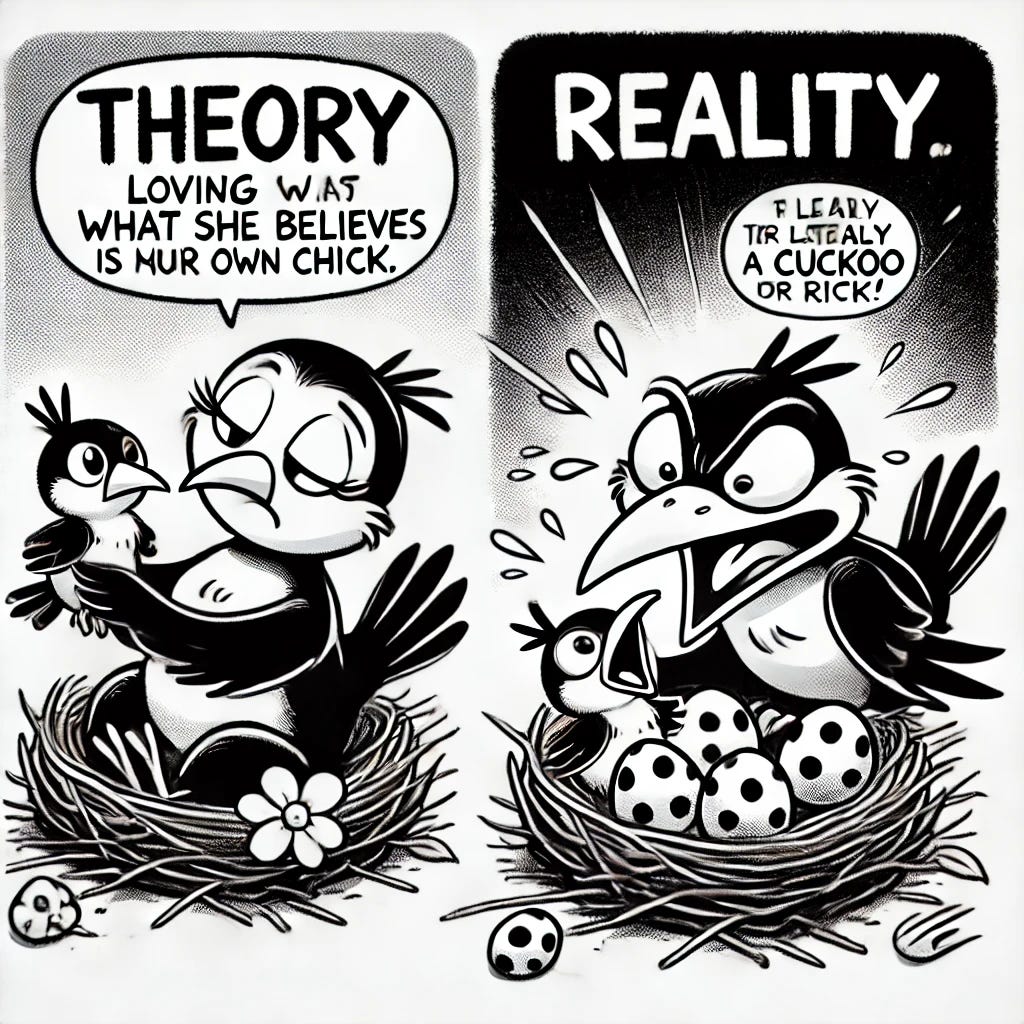

Theory-Induced Blindness: DIBIL in Mathematical Economics

In mathematical economics, a phenomenon known as theory-induced blindness arises when strict adherence to specific models or assumptions prevents the recognition of alternative possibilities or insights outside those frameworks. We refer to this as dogma-induced blindness impeding literacy (DIBIL). DIBIL occurs when false assumptions are conflated with facts, leading to a cognitive blindness that obscures potential truths beyond the established dogma represented by these axioms.

The implications of DIBIL suggest that, although formal systems—whether in mathematics, physics, or economics—are grounded in logical principles, they may still obscure certain aspects of reality that the system’s axioms or structures do not fully capture. This obscurity can arise when the wrong axioms are chosen for a particular task or when assumptions are accepted without sufficient scrutiny.

As demonstrated by Gödel, and reflected in the works of Heisenberg and Turing, there are inherent limitations to knowledge. Gödel’s Incompleteness Theorems show that in any sufficiently powerful formal system, there are true statements that cannot be proven within the system itself. Heisenberg’s Uncertainty Principle reveals fundamental limits to the precision with which certain pairs of physical properties (like position and momentum) can be simultaneously known, highlighting inherent limitations in measurement and predictability. Turing’s Halting Problem establishes that there is no general algorithm capable of determining whether any arbitrary computer program will eventually halt or run indefinitely, underscoring limitations in computational predictability.

These limitations mean that, despite the power of formal systems and the principle of universal causality, our knowledge remains inherently bounded. We can never fully know which axioms are sufficient to model all aspects of reality. Therefore, the risk of dogma-induced blindness exists when we become overly reliant on a single theoretical framework, leading to a narrowed perspective that hinders the discovery of new insights.

However, there is one axiom we should always include in all formal systems, and we can always rely on.

The First, One-Truth Postulate: The Universal Principle of Causality

One principle stands above all others in our understanding of the world: the universal principle of causality, which we define as the first, one-truth postulate of all rational inquiry and formal systems. This principle remains consistent with every known logical and empirical truth. We call it the first, one-truth postulate because it is implicitly embedded in all forms of reasoning—whether in deductive logic, common sense, or scientific thought.

This postulate reflects the ancient Roman adage cui bono—"who benefits?"—suggesting that understanding the likely cause of an effect involves considering who stands to gain. While the cui bono principle may serve as a heuristic in specific real-world contexts and does not always hold true, the first, one-truth postulate of causality remains universally valid. In every context—whether in logical reasoning or empirical reality—the principle of causality asserts that every cause, without exception, produces an effect.

If we cannot rely on this fundamental principle, the very foundation of rational thought and logical deduction collapses. Without it, we would regress to pre-scientific modes of thinking, abandoning the structured reasoning that has driven human progress. Denying this principle would not only undermine scientific advancement but also hinder rational inquiry and judgment, both of which are critical for expanding human knowledge. Rejecting causality would impede the evolutionary progress of humanity, leading to real-world consequences. Without this principle, we would lose the ability to make reasoned judgments—a dire outcome.

Thus, the one principle that can never turn out to be false in our shared objective reality—the one we can always rely on, and the one that precludes theory-induced blindness—is the principle of universal causality, the first, one-truth postulate of all rational systems. While it may have been overlooked or forgotten, it remains central to our understanding and must be remembered well.

This postulate is crucial because, as it pertains to David Hilbert’s program, while Gödel proved that any sufficiently powerful formal system is incomplete, we assert that as long as the law of causality holds in our shared objective reality, any formal system whose axioms are consistent with real-world facts and acknowledges the principle of causality remains relevant for modeling reality. This is because such systems maintain coherence with empirical evidence and logical consistency. This holds true unless the universal law of causality is violated (an exceedingly unlikely event) or one of the system’s axioms contradicts empirically proven facts.

Pascal’s Wager: A Formal System Approach

To illustrate the practical application of formal systems in decision-making, we turn to Pascal’s Wager. Blaise Pascal (1623–1662) was a French mathematician, philosopher, scientist, and inventor who made significant contributions to probability theory, as well as fields such as engineering and physics. He is best known in mathematics for Pascal’s Triangle, a recursive structure used in combinatorics, and for his pioneering work on probability theory, which laid the foundation for modern decision theory and risk analysis. Beyond his contributions to mathematics, Pascal developed one of the first mechanical calculators, the Pascaline, invented the hydraulic press, and made significant contributions to fluid mechanics and geometry. Though disputed, he is sometimes credited with early designs related to the roulette wheel, stemming from his experiments with perpetual motion machines.

This paper focuses on Pascal’s famous philosophical argument known as Pascal’s Wager, which combines his mathematical reasoning with his reflections on belief. Pascal’s Wager presents belief in God through a rational, decision-theoretic lens, framing it as a bet with possible outcomes based on whether God exists. The argument can be summarized as follows:

If God exists and you believe in God, you gain infinite happiness (often conceptualized as eternal life in heaven).

If God exists and you do not believe in God, you suffer infinite loss (often conceptualized as eternal suffering in hell).

If God does not exist and you believe in God, you lose very little (a finite cost of time, resources, etc.).

If God does not exist and you do not believe in God, you gain very little (a finite gain, such as saved time or resources).

Pascal’s reasoning is rooted in probability theory and utility theory: even if the probability of God's existence is low, the infinite value of the potential reward (eternal happiness) outweighs the finite cost of belief. From this perspective, belief in God becomes the rational choice since the potential gain vastly exceeds the potential loss, regardless of the odds (Pascal, 1670).

Pascal’s argument can be viewed through the lens of formal systems and decision theory, where the axioms (beliefs and assumptions about the existence of God) lead to theorems (outcomes or utilities) based on logical inference rules. The wager is built on the assumption that if a decision can lead to an infinite reward with finite cost, it maximizes expected utility to believe, even if the probability of God's existence is small. This aligns with formal logic's approach of deriving consistent outcomes from initial premises.

Clarifying the Concept of Belief: Statistical Hypothesis Testing vs. Religious Faith

Since this paper touches on the subject of God and religion, it is essential to clarify that our approach is rooted in mathematical reasoning—specifically in the context of probability theory and hypothesis testing under uncertainty, and nothing more. This methodology has been consistently applied by the author in a professional context, particularly in financial analysis, highlighting the robustness of this approach. Importantly, this discussion is distinct from the traditional understanding of "belief" or "faith" in a religious context.

In any sound formal system, such as statistics, the term "belief" refers to the selection of the hypothesis most likely to be true based on the available evidence. This sharply contrasts with religious faith, where belief often involves acceptance without empirical evidence or the testing of alternatives.

In statistics, we begin with a hypothesis known as H₀, the null hypothesis, which serves as our default assumption. For example, in a study examining the relationship between cigarette smoking and cancer mortality, H₀ might propose that there is no relationship between smoking and cancer. However, if data from a regression analysis reveal a strong correlation between smoking and increased cancer mortality, we may reject H₀ in favor of H₁, the alternative hypothesis, which posits that there is indeed a relationship.

The decision to "believe" in H₁ over H₀—under the definition of "belief" as it is used in statistics—is based on the likelihood that H₁ is more consistent with objective facts, i.e., the evidence present in our shared reality. Essentially, belief in statistics refers to a rational choice to accept the hypothesis with the higher probability of being true, given the data at hand. This process is guided by probabilistic reasoning and empirical testing, always subject to revision as new data emerge.

This statistical notion of belief—selecting the hypothesis that is more likely to align with reality, even when absolute certainty is unattainable—differs fundamentally from religious belief. In religion, belief often operates on axioms or truths accepted as inviolable, without requiring empirical validation or testing against alternative hypotheses. Religious faith thus hinges on the acceptance of principles that transcend the need for the kind of evidence that drives hypothesis testing in statistics.

Therefore, it is essential to be precise and respectful, acknowledging that belief, especially in the religious context, can be deeply personal and sensitive for many. The goal here is not to challenge religious faith but rather to highlight the distinction between how belief functions in mathematics and how it is understood in religious practice. This is, after all, a paper about formal systems and probabilistic reasoning—not a discourse on theology or faith.

Dually Defined Null Hypothesis

An intriguing aspect of Pascal's Wager, when analyzed rigorously using probability theory, lies in the construction of the null and alternative hypotheses. Pascal posits as an axiom, which we will designate as H₀ (the null hypothesis), that God exists, along with heaven and hell. In applied mathematics and statistics, we typically attempt to disprove H₀ by testing against the alternative hypothesis—H₁, which, in this case, posits that God does not exist.

However, this binary formulation is insufficient. In any correct formal system, particularly in hypothesis testing, failing to consider all relevant alternatives introduces the possibility of what, in statistics, is referred to as a Type II error—failing to reject a false null hypothesis. This represents a lapse in logic and rigor, as it overlooks valid hypotheses that could potentially be true. Such oversights are unacceptable in a proper formal system because they compromise the integrity of the hypothesis-testing process, rendering it fundamentally flawed.

Pascal’s Wager, framed as a bet within the context of a formal system, inherently involves probability—a mathematical discipline that Pascal himself helped to pioneer. As a mathematician, Pascal's intention was to construct a rational decision-making framework. Introducing errors by believing in an axiom that omits alternative hypotheses would contradict the very foundation of his wager. Thus, the wager is not merely a philosophical argument but also a formalized bet based on probabilities. Failing to account for all logical possibilities undermines its mathematical validity.

In the context of Pascal's Wager, we must consider more than just the binary existence or non-existence of a single god. Specifically, the question of how many gods exist must be addressed. According to Peano’s axioms, which describe the properties of natural numbers, we can treat the number of gods, N, as a natural number. Peano’s second axiom states that for any natural number n, there exists a successor n′. This implies that the number of gods could be 0, 1, 2, 3, and so on. Limiting the hypothesis to a single god violates this axiom and introduces logical inconsistency, making the entire system unsound under the inference rules of any valid formal system.

By failing to consider the possibility of multiple gods, we introduce a Type II error into our reasoning—failing to reject a false null hypothesis. This makes any formal system based on such an assumption inherently unsound. To avoid this error, we must expand our hypothesis space beyond the simplistic binary formulation of "God exists" or "God does not exist."

Thus, instead of just two hypotheses, we need at least four to cover a broader range of logical possibilities:

H₀: There is only one God, specifically Yahweh, the God referenced by Pascal. Pascal, as a devout Christian, referred to Yahweh, also known as "the Father" in the New Testament, as the singular, monotheistic God. This deity is also identified as Allah in the Quran, with Islam recognizing the same monotheistic deity worshiped in Christianity and Judaism, though each religion provides its own theological interpretations. This clarification ensures that we are aligning with Pascal’s reference to the God of the Abrahamic traditions—Judaism, Christianity, and Islam—while respecting the nuances in their doctrinal differences.

H₁: There are multiple gods, and Yahweh is the supreme god who should be worshipped above all others.

H₂: There are multiple gods, but Yahweh is not the supreme one to worship.

H₃: There are no gods at all.

By expanding the hypothesis set in this manner, we avoid the logical insufficiency of the original binary formulation and preclude the possibility of a Type II error—failing to reject a false null hypothesis due to inadequate consideration of alternatives. Mathematically, N, the number of gods, could be any natural number, and in a sound formal system, N should range from 0 upwards, reflecting our lack of complete knowledge. Restricting N arbitrarily to just 0 or 1 introduces the risk of Type II error, compromising the integrity—or soundness—of the formal system.

A sound formal system cannot allow such errors, as they conflict with logical rigor. Such oversights would effectively misrepresent the range of possible outcomes. When a formal system permits Type II errors, it becomes logically inconsistent, thereby losing its status as a sound formal system.

This approach aligns with Nassim Taleb's observation that just because we haven’t seen a black swan, it does not mean one does not exist. In probability and hypothesis testing, all plausible alternatives must be considered, or else the process becomes logically flawed.

Dual-Null Hypothesis: H₀ or H₁?

Now the question becomes: which hypothesis should we select as our null hypothesis, H₀ or H₁? Having two different null hypotheses can be problematic because, in applied mathematics, we don't operate on uncertainty—we base our decisions on what can be reasonably deduced. This approach has allowed us to consistently succeed in statistical analysis, where success is grounded in rational, evidence-based decisions. Absolute certainty in the objective reality we share is strictly limited to what can be independently verified. In other words, we can only be absolutely certain about empirical facts and deductive reasoning.

Logical deduction ensures that as long as our axioms are true, the theorems derived from them will also hold true. The accuracy of deductive logic in mathematics is absolute because it can be independently verified. For instance, you can personally prove the Pythagorean Theorem and confirm its validity. In mathematics, if A (axioms) is true, then B (theorems) must logically follow and are guaranteed to hold true both in theory and in reality, as long as the axioms are not violated. This is why using formal systems provides a foundation of certainty that informs our decision-making process—and why 2 + 2 is always 4, unless one of Peano’s axioms is violated. For example, "2 moons of Mars + 2 moons of Mars" does not equal "4 moons of Mars" since Mars only has two moons, Phobos and Deimos. In this case, Peano’s second axiom, which posits that each natural number has a successor, is violated. The formal system of Peano’s arithmetic becomes unsound and inconsistent with reality when its key axioms are violated.

This reminds us that axioms themselves are educated assumptions—initial hypotheses like the ones we are considering now, H₀ or H₁. An axiom is accepted without proof and deemed 'self-evident' by those who propose it—in this case, by ourselves. This brings us to the critical question: which of the hypotheses, H₀ or H₁, should we utilize?

We can avoid arbitrary guessing by following the advice of Bertrand Russell: rather than relying on dogma, we should consult the original sources that Pascal referenced. In this case, according to the Torah, Yahweh, the deity Pascal discussed, commands: "You shall have no other gods before me" (Exodus 20:3, NIV). This implies that H₁—which posits Yahweh as the primary deity, deserving of exclusive worship—should be our null hypothesis.

This acknowledgment of Yahweh as the foremost deity aligns with the concept of multiple gods in other religious traditions, such as in the Bhagavad Gita and the pantheon of Greek and Roman gods, where a hierarchy of divine beings can, in theory, coexist. While it's convenient that H₁ does not contradict the existence of many religions with multiple gods, that’s not the primary reason for choosing H₁ over H₀.

The real reason we must adopt H₁ is that H₀ contains a logical contradiction: it claims both "there are no gods except Yahweh" and "Yahweh is the only god." This creates a conflict because atheism (no gods) and monotheism (one god) are mutually exclusive ideas. Grouping them together violates the law of the excluded middle, a principle in formal logic that states something must either be true or false—there is no middle ground. In a formal system, which underpins hypothesis testing in mathematics and probability theory, contradictions are not allowed because they undermine the binary logic required for consistency. By including such conflicting propositions, even in the form of assumptions or hypotheses, we violate the law of the excluded middle, making the entire system unsound. This is why dividing by zero is prohibited in algebra: after that, you can prove anything, like 2 = 3, and so on.

Thus, if we were to adopt H₀, the entire argument—the formal system—would lose soundness, as it would no longer qualify as a valid formal system.

To put this more plainly, Yahweh asking that "no other gods be placed before Him" while assuming there are no other gods is logically akin to instructing someone to avoid eating lobster, unicorn meat, and pork (where unicorns don’t exist). It’s also similar to asking someone to drive 55 miles per hour from Boston to London across the Atlantic Ocean in a car. For a more concrete example, it's akin to the infamous attempt to legislate that pi equals 3.2—which was proposed in the United States in the early 20th century. These are self-evident fallacies and have no place in rational discussion.

As a result, H₀ cannot serve as a valid hypothesis in the context of any sound formal system. Any theorems derived using H₀ as an axiom would be inherently invalid—coming from a fundamentally unsound formal system. Therefore, any formal system built on H₀—as it attempts to conflate atheism and monotheism—would be logically unsound. This, however, is not a "mathematically proven fact" about atheism itself but rather about the inconsistency within the specific formal system being proposed.

In conclusion, within the context of our logical framework, the hypotheses that remain logically sound are H₁ (Yahweh as the primary deity) and H₂ (other gods may exist, and Yahweh is not necessarily supreme). H₀ (no gods except Yahweh) and H₃ (no gods at all) are logically unsound as axioms in this formal system due to the contradictions they introduce. Historically, many rational thinkers, such as the Greek philosophers, considered the possibility of multiple gods, perhaps to avoid such logical inconsistencies. It's interesting how history unfolds—those deeply rational thinkers may have been onto something after all.

Reconsidering Hypotheses in Formal Systems

Thank you, Blaise Pascal, for your insight, and fortunately, we now live in an era where individuals can hold diverse beliefs without fear of persecution—whether atheist or otherwise. Hopefully, we can all agree on that!

The reason we mention not burning atheists at the stake is that, under a rigorous formal system framework, any axiomatic assumption or belief consistent with atheism (H₀ or H₃) leads to an unsound formal system. This is because such an assumption inherently introduces logical inconsistency by denying the possibility of other valid hypotheses. In statistics, a Type I error occurs when we incorrectly reject a true null hypothesis. In this context, by excluding possible outcomes (such as the existence of multiple gods), we prematurely dismiss hypotheses that could be true, thereby compromising the integrity of our formal system.

In the context of our shared objective reality, the only two hypotheses that remain logically sound are:

H₁: Yahweh (also known as Allah in Islam) is the primary deity.

H₂: Other gods may exist, and Yahweh is not necessarily supreme.

H₀ (no gods except Yahweh) and H₃ (no gods at all) are not only unsound but are also unlikely to hold true in our shared objective reality. This unsoundness arises because H₀ combines mutually exclusive concepts—atheism (no gods) and monotheism (one god)—which creates a logical contradiction. By violating the law of excluded middle, which states that contradictory statements cannot both be true at the same time, we render the formal system inconsistent.

This is why many ancient Greek philosophers considered the existence of multiple gods, each with specific names. Their acceptance of multiple deities allowed them to explore philosophical ideas without encountering logical contradictions within their formal systems. By considering the existence of multiple gods, they maintained logical consistency and soundness in their reasoning. Perhaps they were onto something after all!

In constructing a sound formal system, especially when dealing with metaphysical concepts like the existence of deities, it is crucial to avoid logical contradictions and consider all plausible hypotheses. By excluding potential outcomes or combining mutually exclusive concepts, we introduce errors that compromise the system's integrity.

Therefore, H₁ and H₂ remain the logically sound hypotheses within our formal framework, as they do not introduce contradictions and allow for a consistent exploration of possibilities. This careful consideration ensures that our formal system remains robust, reliable, and free from inherent logical errors.

Addressing Common Objections under H₁

The Sincerity Objection: One common objection is that believing in God simply to avoid hell may seem insincere, potentially leading to the very outcome one hopes to avoid. However, under the properly selected H₁ hypothesis (which posits Yahweh as the primary deity), even an attempt to believe in Yahweh results in a relative risk reduction of going to hell. In this context, striving for sincere belief is a rational choice within the framework of Pascal’s Wager. Thus, this objection does not hold in a rational argument about God.

The Infinite Utility Problem: This objection focuses on the use of infinite rewards (heaven) and infinite punishments (hell) in rational decision-making, arguing that infinite values distort the process by making all finite outcomes seem irrelevant. This objection misunderstands the nature of Pascal's Wager. The wager relies on accepting the infinite nature of the rewards and punishments as a premise. Questioning their infinite nature changes the foundational assumptions of Pascal’s argument. Therefore, to evaluate the decision rationally within this framework, one must accept the infinite stakes (Pascal, 1670).

The Moral Objection: Another objection suggests that believing in God purely out of self-interest is morally questionable, reducing faith to a selfish gamble rather than sincere devotion. Even if initial belief stems from self-interest, it can be a starting point for genuine faith and moral growth over time. As belief deepens, sincerity and authentic devotion may develop, making this objection less relevant in the long term (Pascal, 1670).

The Probability Objection: This objection challenges the assumption that even a small probability of God’s existence justifies belief due to the infinite reward, arguing that assigning probabilities to metaphysical claims is inherently problematic. While the probability of God's existence may be uncertain, it is not necessarily negligible. With no prior knowledge of the true probability, the principle of indifference suggests assigning an initial estimate of 50%. Therefore, the potential for an infinite reward still justifies belief within Pascal's framework (Pascal, 1670; see Roger Penrose's work on unknowable probabilities).

The Cost Objection: Some argue that Pascal's Wager underestimates the potential costs of belief, including sacrifices in time, resources, and personal freedoms. However, one does not need to devote excessive resources to hold a belief in God. Moderate religious practices can be integrated into one's life without significant sacrifices, minimizing potential costs while still allowing for the possibility of infinite rewards (Pascal, 1670).

The Agnosticism Objection: This objection argues that Pascal’s Wager presents belief as a binary choice, potentially ignoring the rational stance of agnosticism. However, the wager addresses the reality that either God exists or does not—this is a binary fact. Agnosticism reflects uncertainty about this reality, but in decision-making under uncertainty, Pascal's Wager suggests that belief is the rational choice due to the potential infinite reward.

The Many Gods Objection: This objection posits that, given the multitude of belief systems, believing in the "wrong" God might still result in negative consequences. While there are many belief systems, Pascal specifically advocated for belief in Yahweh, the God referred to in the Ten Commandments: "You shall have no other gods before me" (Exodus 20:3, NIV). Yahweh, also known as "The Father" in the New Testament and "Allah" in the Qur’an, is the one God that Pascal’s Wager advises belief in.

At this point, it's worth recalling a quote—often attributed to Mark Twain but not definitively confirmed: "It’s not what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so." In any rigorous analysis, it's essential to reference original sources rather than rely on second-hand interpretations. We encourage careful examination of source material to ensure a thorough understanding of the wager and its underlying formal systems.

To clarify further: under the properly formulated H₁ hypothesis, worship of non-Yahweh entities is classified as idol worship, which is self-evident by definition—worshipping a false god constitutes idolatry. However, this classification does not contradict the fact that the Torah mentions multiple supernatural entities, such as angels, cherubim, seraphim, nephilim, and giants. Some of these beings obey Yahweh, while others do not. Under H₁, these entities are considered "false gods" in the context of worship but may still exist as conscious beings distinct from humans.

The only remaining task is to determine whether H₁ (Yahweh is the primary deity) or H₂ (other gods may exist, and Yahweh is not necessarily supreme) is true. As we use a formal system to reach a conclusion, we cannot use H₀ (no gods except Yahweh) and H₃ (no gods at all) as axioms. This is not because they could never turn out to be true, but because they are unsound and are encompassed by the sound axioms. In other words, under the H₁ hypothesis, it could turn out to be the case that H₀ is true, but under the H₀ hypothesis, it could never turn out to be the case that H₁ is true, making H₀ inherently unsound. The same logic applies to H₃. H₀ and H₃ are simply bad axioms that cannot be used in rational discourse. But don’t worry, dear reader—we won’t leave you lurking in the dark; we will provide an answer. However, we will return to Pascal and God later. For now, let’s return to the main topic of this paper: the consequences of using the wrong axioms for the task at hand.

Interpreting John Kerry's Statement

John Kerry's Quote:

"It's really hard to govern today. You can't—the referees we used to have to determine what is a fact and what isn't a fact have kind of been eviscerated, to a certain degree. And people go and self-select where they go for their news, for their information. And then you get into a vicious cycle."

John Kerry’s comment reflects his concern over the diminishing influence of traditional authoritative sources—referred to as “referees”—who once played a central role in determining what is considered factual but are no longer universally trusted. He expresses frustration over the challenge of governing in an environment where individuals increasingly self-select their sources of news and information, leading to a cycle of reinforcing existing biases.

However, Kerry’s perspective raises important questions. Facts, by definition, do not require referees or authority figures; the truth of objective facts is independently verifiable by any rational individual, regardless of the source presenting them. His frustration may stem from the difficulty of governance in a fragmented media landscape, where individuals often favor narratives that align with their personal beliefs rather than seeking out objective facts.

While Kerry laments the erosion of trusted arbiters of truth, the real-world situation is more nuanced. People may be rejecting unverified claims that traditionally went unquestioned, which can either lead to more critical thinking and skepticism or cause individuals to self-select information based on ideological alignment rather than verifying the accuracy of claims.

Kerry implies that governance becomes difficult without universally trusted referees to establish facts. However, true facts are objective and verifiable, regardless of any authority. This highlights the need for public literacy and critical thinking when approaching unverified claims. Kerry seems to conflate subjective beliefs and opinions with objective facts, expressing concern over the loss of control in shaping which narratives dominate public discourse. What he may be mourning is the loss of a monopoly over dogma—claims presented as facts but lacking independent verifiability.

This distinction is crucial under U.S. common law: facts are independently verifiable, while dogma or hearsay are merely assertions that can be used by dishonest actors to manipulate or mislead. In libel law, for example, truth is an absolute defense, emphasizing the legal and moral principle that facts, when verifiable, stand independently of opinion or authority.

Content Warning: Sensitive Example

If someone refers to a convicted criminal as a "diseased pederast" after they were convicted of child abuse and contracted a disease in prison, such a statement would be legally protected under U.S. libel law—but only if both the conviction and medical condition are verifiable facts. Even highly insulting statements are legally protected if factually accurate. This example underscores the importance of distinguishing between objective facts and subjective opinions, highlighting the need to be mindful of how facts are presented, especially when dealing with sensitive topics.

More important than the legal aspects, this example illustrates the necessity of separating verifiable facts from subjective opinions. While facts, when independently verifiable, are protected both legally and morally, factual statements can have harmful consequences if presented in a derogatory or harmful way. It is essential to handle facts with care and respect, especially in discussions of sensitive topics, as the presentation of facts can significantly affect others. Nonetheless, there is a clear distinction between fact and hearsay.

Key Points

Integrity of Facts: A clear distinction between verifiable facts and subjective opinions is essential for public discourse, decision-making, and governance. Kerry’s statement raises concerns about losing centralized authorities to arbitrate facts, but facts do not require arbitration—they require verification. As the saying goes, "You are entitled to your opinions, but not your own facts." For society to function cohesively, it must distinguish between dogma (claims that may be false) and objective facts (those that are independently verifiable and cannot be false).

Public Discernment: The ability to critically evaluate information and distinguish facts from unverified claims is essential to combat misinformation. Encouraging the public to reject hearsay in favor of verifiable truths strengthens societal resilience against false narratives.

Verification Mechanisms: Independent verification is the cornerstone of ensuring that factual claims remain accurate and trustworthy. Unlike opinions or hypotheses, facts are valid because they can be verified through proper methodology, not because an authority declares them so. This applies to both scientific inquiry and public discourse.

By emphasizing the importance of independently verifiable facts, as opposed to hearsay or subjective interpretations, this analysis highlights the critical role of objective truth in maintaining societal cohesion. In contrast to dogma, facts are unchangeable truths, much like how 2 + 2 = 4 is always true in the formal system of arithmetic, provided its axioms hold. Understanding the distinction between facts and opinions is fundamental to effective governance, communication, and public discourse.

By adhering to objective truths, fostering public discernment, and upholding mechanisms for verifying facts, society can safeguard itself against misinformation and ensure that decisions are based on reliable, independently verifiable information. This strengthens not only the fabric of society but also rational discourse, governance, and decision-making processes.

Theory-Induced Blindness: The Role of Dogma

Theory-Induced Blindness (TIB) is a cognitive bias described by Daniel Kahneman in his 2011 book Thinking, Fast and Slow. Rather than summarizing, let’s refer directly to Kahneman’s words:

"The mystery is how a conception of the utility of outcomes that is vulnerable to such obvious counterexamples survived for so long. I can explain it only by a weakness of the scholarly mind that I have often observed in myself. I call it theory-induced blindness: once you have accepted a theory and used it as a tool in your thinking, it is extraordinarily difficult to notice its flaws. If you come upon an observation that does not seem to fit the model, you assume that there must be a perfectly good explanation that you are somehow missing. You give the theory the benefit of the doubt, trusting the community of experts who have accepted it."

Kahneman's description emphasizes the difficulty of challenging established theories due to TIB. This bias occurs when individuals become so invested in a theory that they fail to recognize its flaws, often attributing inconsistencies to their own misunderstandings rather than questioning the theory itself.

Scientific theories, as applied formal systems, are structured sets of assertions logically deduced from underlying axioms or hypotheses. Theory-Induced Blindness (TIB) does not arise from the theory's logical structure but from an implicit assumption embedded in its axioms—a dogma, or an accepted truth without empirical verification. Any theory that induces blindness is logically deduced from such a dogmatic axiom using sound reasoning.

The blindness results not from long-term use of the flawed theory but from the false axiom underpinning it. Axioms, by definition, are accepted as true without proof. However, if an axiom turns out to be incorrect, the entire theory derived from it must be revised. Facts are immutable and verifiable, but axioms are assumptions that may be flawed.

Kahneman supports this idea in his critique of Daniel Bernoulli’s flawed theory of how individuals perceive risk:

"The longevity of the theory is all the more remarkable because it is seriously flawed. The errors of a theory are rarely found in what it asserts explicitly; they hide in what it ignores or tacitly assumes."

This quote reinforces the idea that Theory-Induced Blindness (TIB) arises from an incorrect axiom—a tacit assumption that does not reflect reality. While the theory itself may remain logically valid within its formal system, it fails to accurately describe reality because its foundation is flawed—contradicted by established objective facts. For example, Peano’s second axiom states that for every natural number n, there exists a successor n'. However, this assumption may not hold true in certain real-world contexts, such as counting physical objects like Mars' moons. Since Mars only has two moons, the concept of a continual successor fails in this context. This illustrates how an axiom that works perfectly within a formal system can break down when applied to the complexities of physical reality.