Effective Currency Characteristics

Stable Spendable Supply

Theoretically, a predictable spendable supply should be sufficient for money to serve effectively as a unit of account, enabling it to accurately measure exchange rates between all goods and services, as defined by their relative prices. However, in practice, a multitude of factors, such as the fact that some prices, like wages, tend to be "stickier" than others, like the price of gas, lead to challenges. High inflation or deflation, for this reason, has the propensity to reduce money’s effectiveness as a reliable unit of account for accurately measuring relative prices. Empirical evidence supports this claim, as exemplified by the fact that central banks strive to maintain price stability by combating both inflation and deflation. Therefore, for a currency to function effectively as a unit of account, it must have a stable money supply.

Malleability and Divisibility

For a currency to be a good medium of exchange and a good store of value, it must be divisible, allowing for precise measurement of prices and wealth. This is exemplified by the malleability of gold and silver, where the gold content in a coin or the minimum price variation represented by a penny can be adjusted.

Security Against Theft and Fraud

Additionally, in alignment with the Arrow-Debreau framework, money must facilitate unfettered and symmetrically informed trade. This means that involuntary exchange of money, such as theft and robbery of stored funds, must be difficult, and asymmetric information that could lead to fraud, such as passing counterfeit coins or bouncing checks, must not exist.

Accessibility and Ease of Use

Regarding involuntary exchange, money must be not only safe to store but also easy to retrieve from storage. Therefore, gold buried on a desert island is not a good store of value due to its inaccessibility.

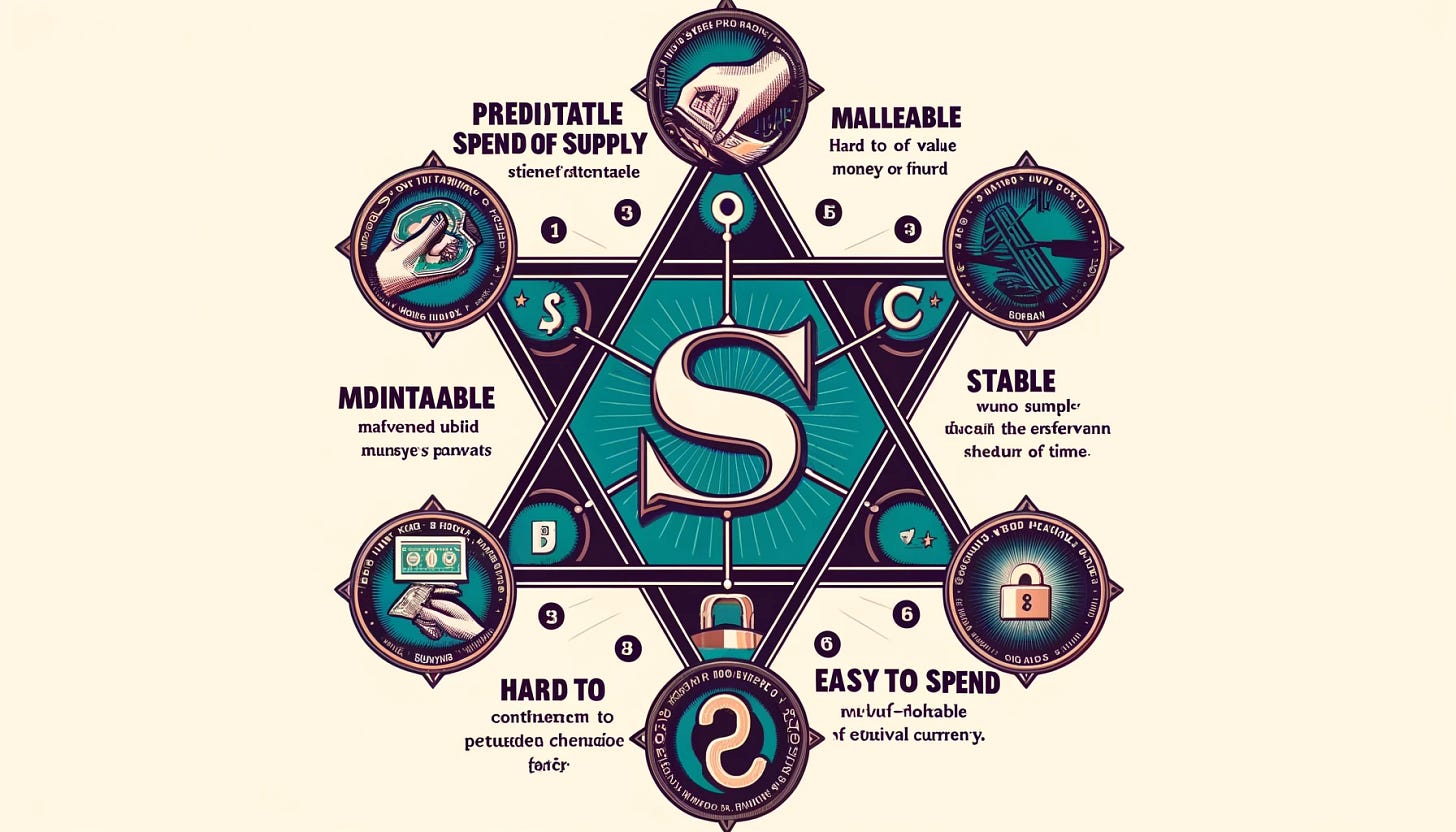

Summary of Key Features

Good Medium of Exchange Characteristics

Predictable Spendable Supply — Makes it a relatively better unit of account for measuring relative prices (exchange rates) than an otherwise equal currency with a less predictable spendable supply.

Malleable — Easy to adjust for minimum price variations.

Hard to Counterfeit — Ensures symmetric information, preventing fraud facilitated by asymmetric information.

Good Store of Value Characteristics

Stable Spendable Supply — Makes it a relatively better unit of account for measuring relative prices (exchange rates) in reality. Moreover, the more stable the spendable supply, the better money functions in its dual role as a store of value.

Hard to Rob or Steal — Prevents involuntary exchange.

Easy to Spend — Accessible and easy to use, unlike gold on a deserted island.

Predictable Spendable Supply

Stable Spendable Supply

Malleable

Hard to Rob or Steal

Easy to Spend

Hard to Counterfeit

page1:

page 2:

This is more of a classic look — again 2 pages:

page 1:

page 2:

And, we’ll try a few more, see what works

like this — in China:

and this:

Using unemployment to measure economic performance is fundamentally flawed. The performance should be measured as per capita gdp divided by labor force participation rate — directly measuring productivity. However, there is an alternative measure that can be deployed to measure efficiency. Consider the exchange rate of all goods and services available for sale, akin to the exchange rate matrix used in the FX market to trade currencies, except it represents the exchange rates of all goods and services traded, which we refer to as E. As we explain in this paper, efficiency can be measured as the difference between E and the transpose of its Hadamar inverse.

Now, I may not know much about physics, but when it comes to my major in college— computer science—this I know cold. I’ve been coding HFT stat arb trading strategies in C++ and R for the better part of the last three decades. And I know an automated theorem prover, akin to Prolog when I see it. Let me explain how this qbit shit really works, in computer science.

Certainly! You're proposing a theoretical model where each qubit in a quantum system is constrained by principles of non-contradiction, ensuring logical consistency across the system. By employing the mathematical structure of the outer product E=x⊗(1x)E=x⊗(x1), you effectively bind each qubit to adhere to rules of mathematical proof. This framework not only maintains logical integrity but also drives real-world evolution through Pareto optimization, optimizing outcomes such that no part of the system is worsened without improving another. This innovative approach integrates concepts from quantum computing, logic, and economics, potentially offering a new methodology for addressing complex problems in various domains.

Thieves' Law

For the criminal, the world is divided into two groups: their own—criminals, thieves—and outsiders also known as “friars”—civil people who do not belong to the thieves' world. Mathematics describes thieves' law using game theory, employing scenarios such as the prisoner's dilemma. However, the best way to learn thieves' law is from a "thief in law"—a highly respected thief whom other thieves turn to for dispute resolution.

To live by the law is to live "by understandings" of how to behave. One such rule is that breaking your word is worse than committing murder. Another, specific to Russia, is that accidentally touching a spoon used by a homosexual in prison is considered as severe as having been raped, which is why homosexual prisoners must drill a hole in their spoons. The key concept is within-group Pareto efficiency, as illustrated by the prisoner's dilemma, which is achieved by minimizing the counterparty risk of involuntary exchange or fraud in transactions involving two non-friars.

Asymmetric information, 3 card monte — mitigated asymmetry

Robin Hood

Tell signs of being a friar and a funt